Eb5 Immigrant Investor Program Things To Know Before You Get This

Eb5 Immigrant Investor Program Things To Know Before You Get This

Blog Article

Eb5 Immigrant Investor Program for Beginners

Table of ContentsEb5 Immigrant Investor Program - An OverviewSome Ideas on Eb5 Immigrant Investor Program You Need To KnowThe smart Trick of Eb5 Immigrant Investor Program That Nobody is DiscussingThe 30-Second Trick For Eb5 Immigrant Investor ProgramEb5 Immigrant Investor Program - QuestionsLittle Known Questions About Eb5 Immigrant Investor Program.

Despite being less preferred, other paths to obtaining a Portugal Golden Visa include financial investments in venture funding or exclusive equity funds, existing or new service entities, capital transfers, and donations to sustain clinical, technical, imaginative and cultural advancements. Owners of a Portuguese resident permit can likewise function and research in the country without the requirement of getting additional licenses.

The Definitive Guide to Eb5 Immigrant Investor Program

Investors must have both a successful entrepreneurial history and a substantial business record in order to use. They might include their partner and their kids under 21-years- old on their application for long-term house. Effective candidates will certainly get a sustainable five-year reentry permit, which allows for open travel in and out of Singapore.

Indicators on Eb5 Immigrant Investor Program You Should Know

Candidates can invest $400,000 in federal government approved genuine estate that is resalable after 5 years. Or they can spend $200,000 in government accepted real estate that is resalable after 7 years.

.jpg)

This is the major advantage of coming in to Switzerland compared to various other high tax obligation countries. In order to be qualified for the program, applicants need to Be over the age of 18 Not be utilized or inhabited in Switzerland Not have Swiss citizenship, it needs to be their very first time staying in Switzerland Have rented out or purchased home in Switzerland Provide a long checklist of identification papers, consisting of clean criminal document and good moral personality It takes about after repayment to get a resident permit.

Tier 1 visa holders stay in standing for regarding three years (depending upon where the application was filed) and need to relate to extend their remain if they desire to continue residing in the UK - EB5 Immigrant Investor Program. Prospects should have personal properties that worth at more than 2 million and have 1 countless their very own cash in the U.K

Eb5 Immigrant Investor Program Fundamentals Explained

The Tier 1 (Entrepreneur) Visa stands for 3 years and 4 months, with the choice to extend the visa for an additional 2 years. The applicant may bring their reliant household members. Once the business owner has been in the United Kingdom for 5 years, they can obtain uncertain delegate stay.

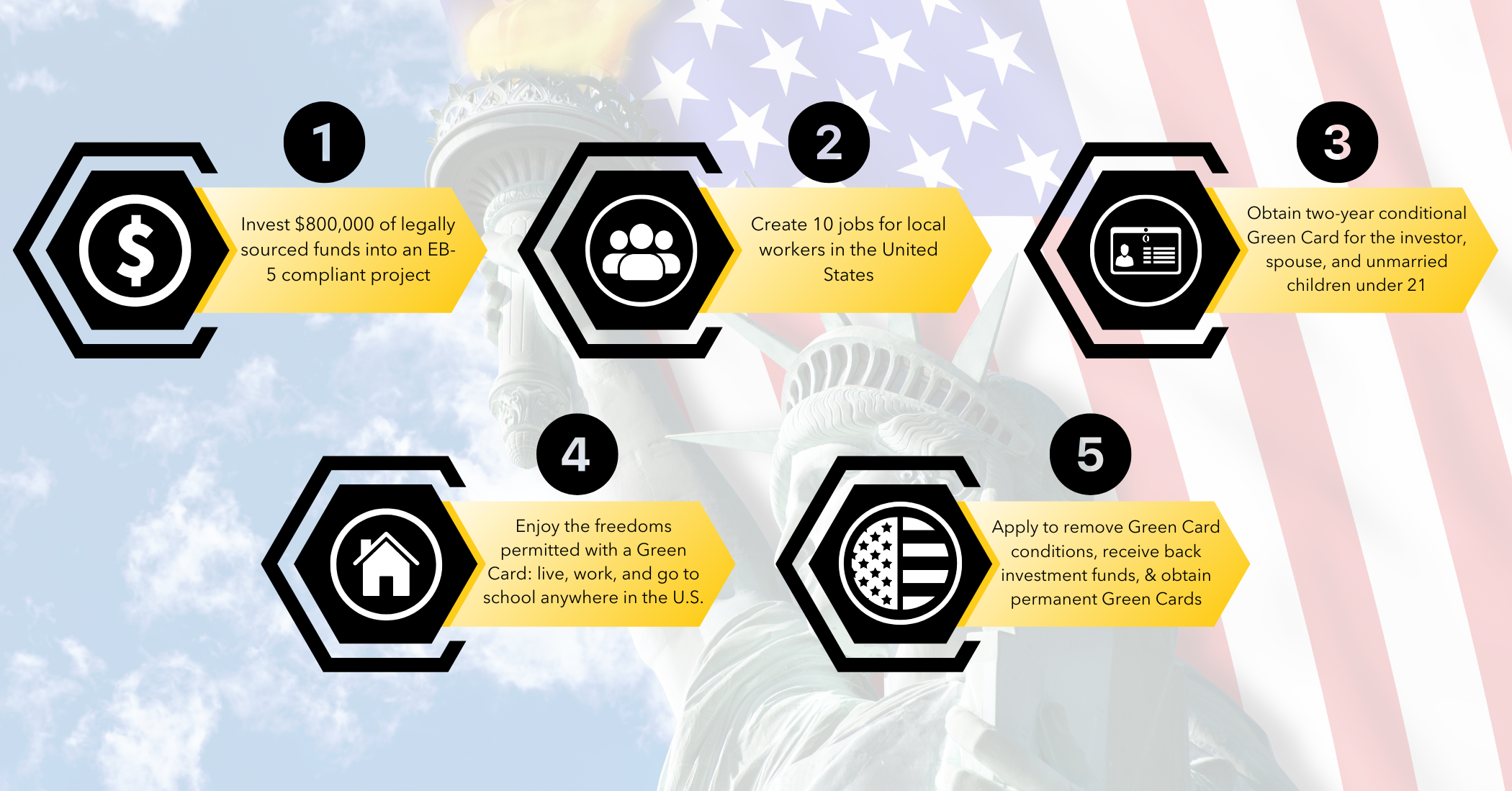

Investment migration has gotten on an upward fad for greater than two years. The Immigrant Investor Program, additionally known as the EB-5 Visa Program, was developed by the U.S. Congress in 1990 under the Migration Act of 1990 or IMMACT90. Its primary objective: to promote the over here united state economic climate through task creation and resources investment by international financiers.

This consisted of decreasing the minimal investment from $1 million to $500,000. With time, modifications have actually enhanced the minimal investment to $800,000 in TEAs and $1.05 million in other locations. In 1992, Congress sought to boost the impact of the EB-5 program by introducing the Regional Facility Pilot Program. These privately-run entities were designated to promote financial growth and task production within particular geographical and sector sectors.

Unknown Facts About Eb5 Immigrant Investor Program

Designers in rural areas, high joblessness locations, and facilities jobs can benefit from a dedicated swimming pool of visas. Financiers targeting these particular areas have actually a raised probability of visa accessibility.

Capitalists now have the possibility to invest in government-backed framework projects. Capitalists need to be conscious of the approved types of investment funds and arrangements. Capitalists and their families currently legally in the U.S. and qualified for a visa number might concurrently submit applications for modification of condition along with or while waiting for adjudication of the investor's I-526 request.

This simplifies the procedure weblink for investors already in the U.S., accelerating their capability to change condition and staying clear of consular visa handling. Financiers navigate to these guys looking for a quicker handling time may be a lot more likely to invest in rural jobs.

What Does Eb5 Immigrant Investor Program Do?

Searching for U.S. government details and services?

The EB-5 program is a chance to create work and stimulate the U.S. economic climate. To qualify, candidates need to purchase brand-new or at-risk companies and develop full-time placements for 10 qualifying employees. The united state economy advantages most when a place goes to danger and the brand-new financier can provide a functioning establishment with complete time jobs.

TEAs were applied into the financier visa program to urge purchasing locations with the greatest requirement. TEAs can be backwoods or locations that experience high unemployment. A backwoods is: outside of typical metropolitan statistical locations (MSA), which is a city and the surrounding areas within the external border of a city or community with a populace of 20,000 or more A high unemployment area: has experienced unemployment of a minimum of 150% of the nationwide average price An EB-5 regional facility can be a public or exclusive financial unit that promotes financial growth.

Report this page